We're very excited to announce that Lisa Huff, our Chief Technology Analyst here at DataCenterStocks.com, will be teaching a short course at the 2011 OFC show on Copper vs. Fiber in the Data Center.

More detail on the course should be available shortly at http://www.ofcnfoec.org/Short_Courses/index.aspx.

Friday, July 30, 2010

Top-of-Rack Switching – Better or Worse for Your Data Center? (Part 2)

by Lisa Huff

Last week I gave you some reasons why a Top-of-Rack (ToR) switching architecture could be higher cost for your data center network. Today, I’d like to discuss the advantages of using a ToR switching topology.

1) CLOS network architecture – in order to support this, you most likely need to use a ToR switch. For those not familiar with the CLOS network, it is a multi-stage network whose main advantage is that it requires fewer cross-points to produce a non-blocking structure. It is difficult and can be more costly to implement a non-blocking network without CLOS.

2) Latency and throughput – while it may be counter-intuitive, there may be less latency in your network if you use a ToR switch architecture. The main reason really has little to do with the switch itself and more to do with the data rate of your network. 10-Gigabit Ethernet typically has about 1/5th the latency that Gigabit Ethernet does. It also obviously has the capability of 10 times the throughput – provided that your switches can support line-rate (their backplanes can handle 10 Gbps). So implementing 10GigE in your equipment access layer of your data center can seriously reduce the amount of time data takes to get from initiator to destination. This, of course, is more critical in some vertical markets than in others – like the financial sector where micro-seconds can make a difference of millions of dollars made or lost.

A comment on latency and throughput however – if this is so critical, why not use InfiniBand instead of Ethernet ToR switches? It seems to me that InfiniBand already has these issues solved without adding another switch layer to the network.

Last week I gave you some reasons why a Top-of-Rack (ToR) switching architecture could be higher cost for your data center network. Today, I’d like to discuss the advantages of using a ToR switching topology.

1) CLOS network architecture – in order to support this, you most likely need to use a ToR switch. For those not familiar with the CLOS network, it is a multi-stage network whose main advantage is that it requires fewer cross-points to produce a non-blocking structure. It is difficult and can be more costly to implement a non-blocking network without CLOS.

2) Latency and throughput – while it may be counter-intuitive, there may be less latency in your network if you use a ToR switch architecture. The main reason really has little to do with the switch itself and more to do with the data rate of your network. 10-Gigabit Ethernet typically has about 1/5th the latency that Gigabit Ethernet does. It also obviously has the capability of 10 times the throughput – provided that your switches can support line-rate (their backplanes can handle 10 Gbps). So implementing 10GigE in your equipment access layer of your data center can seriously reduce the amount of time data takes to get from initiator to destination. This, of course, is more critical in some vertical markets than in others – like the financial sector where micro-seconds can make a difference of millions of dollars made or lost.

A comment on latency and throughput however – if this is so critical, why not use InfiniBand instead of Ethernet ToR switches? It seems to me that InfiniBand already has these issues solved without adding another switch layer to the network.

Labels:

10 Gigabit,

InfiniBand

Thursday, July 29, 2010

Equinix Revenue Per Cabinet Up 8% Y/Y in North America

Wall Street loved Equinix's (EQIX) earnings report, with the stock closing up 6.5% today, even though it came in at expected revenue and EBITDA levels, and the company only lifted EBITDA guidance by a fraction.

The company's year-over-year revenue growth, excluding Switch & Data, was 21%, down from 25% last quarter. In addition to expansion, this continued revenue growth was helped by monthly recurring revenues per cabinet climbing to $2,053 in North America, up 8% from $1,893 a year ago. Overall revenue growth per cabinet was held back by the Euro falling during the quarter, but this is an important element of what the company claims is a 30-40% 5 year IRR on its investment in the IBX centers.

The company has over $2 billion of debt, but with adjusted EBITDA margins in the low 40s, it is not facing any major liquidity issues. With a debt/equity ratio over 1, the company is essentially borrowing away to build capacity beyond what any competitor will ever likely reach, while keeping its cost of capital down. And with not only revenue growing, but revenue per cabinet increasing, it is hard to argue against this strategy. However, it will be interesting to see what happens with Telx, which does just 1/10th the revenue Equinix does now, but leases its facilities instead of buying them. As a result, it has a Revenue/PP&E ratio of 1.5, compared to .6 for Equinix. The trade-off is that Telx's EBITDA margins are about 20 points lower, but could improve once that provider grows. Either way, the limited space in key markets like Northern New Jersey and Northern Virginia is helping both providers right now.

The company's year-over-year revenue growth, excluding Switch & Data, was 21%, down from 25% last quarter. In addition to expansion, this continued revenue growth was helped by monthly recurring revenues per cabinet climbing to $2,053 in North America, up 8% from $1,893 a year ago. Overall revenue growth per cabinet was held back by the Euro falling during the quarter, but this is an important element of what the company claims is a 30-40% 5 year IRR on its investment in the IBX centers.

The company has over $2 billion of debt, but with adjusted EBITDA margins in the low 40s, it is not facing any major liquidity issues. With a debt/equity ratio over 1, the company is essentially borrowing away to build capacity beyond what any competitor will ever likely reach, while keeping its cost of capital down. And with not only revenue growing, but revenue per cabinet increasing, it is hard to argue against this strategy. However, it will be interesting to see what happens with Telx, which does just 1/10th the revenue Equinix does now, but leases its facilities instead of buying them. As a result, it has a Revenue/PP&E ratio of 1.5, compared to .6 for Equinix. The trade-off is that Telx's EBITDA margins are about 20 points lower, but could improve once that provider grows. Either way, the limited space in key markets like Northern New Jersey and Northern Virginia is helping both providers right now.

Akamai Selloff is Completely Unjustified

Akamai (AKAM) reported quarterly revenue yesterday of $245 million, up from $240 million last quarter, and $205 million for the last year.

The stock is getting hit hard, however, as some traders seem concerned about a slight EPS hit, some of which is from currency conversions, as well as rumors of heavy price competition against Level 3 (LVLT) and Limelight (LLNW).

I think this beating is completely unjustified. The stock has a P/E of 30 overall, which drops to around 25 when you factor out its $1.1 billion cash balance. Moreover, the analysts on the call yesterday were fretting about one or two points of gross margin. I've been doing financial plans for telecom service providers for over a decade, and not one has come close to a 70% gross margin on a GAAP basis, or the low 80s on a cash basis. Moreover, the difference in cash and GAAP gross margins shows what a poor job financial accounting does of revealing cost structure with depreciation and stock-based compensation thrown into the Cost of Goods Sold line. This is why I recommend modeling businesses like this using managerial accounting techniques. Contribution margin provides a lot more insight into future profitability than GAAP gross margin for a company like this.

In addition to Wall Street's sudden concern about valuation, the strangest reaction I've seen to the earnings call is Citi's comment about competitors and pricing. CDNs are like semiconductors, the prices are almost always declining, but the margins remain high throughout because the underlying costs are declining at the same rate. This is Microeconomics 101, prices for CDN services will keep dropping because the marginal costs of delivering them keep dropping. The servers and network connections in Akamai's network aren't getting more expensive. Moreover, Akamai's got the lowest cost per bit because its got the largest CDN network. Its operating margins have been holding around 25%, while competitor Limelight has been holding around minus 15%. Competitors therefore have to go Akamai's cost per bit, so guess who gets hurt more in a price war. Moreover, it takes a lot of specialized, expensive knowledge to sell CDN services, which is one reason why telcos have struggled with it, because they could easily handle the capital requirements. At the end of last year, Akamai had 820 people in sales and support. Even large telcos don't have this level of CDN expertise, which is why Verizon and Telefonica resell Akamai's service rather than trying to compete against it.

There might be temporary spikes up and down, but this company has accumulated over $1 billion in cash while prices for its service have kept dropping. If Intel (INTC) can hold a $120 billion market cap for a business with no pricing power but the lowest marginal cost per unit of production, Akamai's $1.1 billion of cash and quarter billion of operating income are certainly enough to justify a $7.5 billion market cap.

The stock is getting hit hard, however, as some traders seem concerned about a slight EPS hit, some of which is from currency conversions, as well as rumors of heavy price competition against Level 3 (LVLT) and Limelight (LLNW).

I think this beating is completely unjustified. The stock has a P/E of 30 overall, which drops to around 25 when you factor out its $1.1 billion cash balance. Moreover, the analysts on the call yesterday were fretting about one or two points of gross margin. I've been doing financial plans for telecom service providers for over a decade, and not one has come close to a 70% gross margin on a GAAP basis, or the low 80s on a cash basis. Moreover, the difference in cash and GAAP gross margins shows what a poor job financial accounting does of revealing cost structure with depreciation and stock-based compensation thrown into the Cost of Goods Sold line. This is why I recommend modeling businesses like this using managerial accounting techniques. Contribution margin provides a lot more insight into future profitability than GAAP gross margin for a company like this.

In addition to Wall Street's sudden concern about valuation, the strangest reaction I've seen to the earnings call is Citi's comment about competitors and pricing. CDNs are like semiconductors, the prices are almost always declining, but the margins remain high throughout because the underlying costs are declining at the same rate. This is Microeconomics 101, prices for CDN services will keep dropping because the marginal costs of delivering them keep dropping. The servers and network connections in Akamai's network aren't getting more expensive. Moreover, Akamai's got the lowest cost per bit because its got the largest CDN network. Its operating margins have been holding around 25%, while competitor Limelight has been holding around minus 15%. Competitors therefore have to go Akamai's cost per bit, so guess who gets hurt more in a price war. Moreover, it takes a lot of specialized, expensive knowledge to sell CDN services, which is one reason why telcos have struggled with it, because they could easily handle the capital requirements. At the end of last year, Akamai had 820 people in sales and support. Even large telcos don't have this level of CDN expertise, which is why Verizon and Telefonica resell Akamai's service rather than trying to compete against it.

There might be temporary spikes up and down, but this company has accumulated over $1 billion in cash while prices for its service have kept dropping. If Intel (INTC) can hold a $120 billion market cap for a business with no pricing power but the lowest marginal cost per unit of production, Akamai's $1.1 billion of cash and quarter billion of operating income are certainly enough to justify a $7.5 billion market cap.

I/O Virtualization vs. Fibre Channel over Ethernet

by David Gross

Somehow vendors always want to converge networks just when IT managers are finding new applications for existing technologies. This results in new products banging against unintended uses for established technologies. In turn, vendors create new “convergence” tools to pull everything back together, which then bump up against the IT managers' new applications, and the cycle repeats. This has been a pattern in data networking for at least the last 15 years, where vendor visions of one big happy network have kept colliding with the operating reality of a network that keeps diverging and splitting into new forms and functions. If reality had played out like vendor PowerPoints of years past, we'd all have iSCSI SANs incorporated into IPv6 based-LANs, and Fibre Channel and InfiniBand would be heading to the history books with FDDI and ATM.

Like previous attempts to force networks together, current attempts to do so require expensive hardware. As I pointed out a couple of weeks ago, Fibre Channel over Ethernet looks good when modeled in a PowerPoint network diagram, but not so great when modeled in an Excel cost analysis, with its CNAs still topping $1,500, or about 3x the cost of 10 Gigabit Ethernet server NICs. But this is not the only way to glue disparate networks together, I/O Virtualization can achieve the same thing by using an InfiniBand director to capture all the Ethernet and Fibre Channel traffic.

I/O Virtualization can offer a lower cost/bit at the network level than FCoE, because it can run at up to 20 Gbps. However, I/O Virtualization directors are more expensive than standard InfiniBand directors. Xsigo's VP780, sold through Dell, sells for around $1,000 per DDR port, while a Voltaire (VOLT) 4036E Grid Director costs about $350 per faster QDR port. But this could change quickly once the technology matures.

One major difference in the configuration between standard InfiniBand and I/O Virtualization is that a typical InfiniBand director, such as a Voltaire 4036E, bridges to Ethernet in the switch, while Xsigo consolidates the I/O back at the server NIC. The cost of the additional HCA in the standard InfiniBand configuration is about $300 per port at DDR rates and $600 per port at QDR rates. A 10 Gigabit Ethernet server NIC costs around $500 today, and this price is dropping, although there is some variability based on which 10 Gigabit port type is chosen – CX4, 10GBASE-T, 10 GBASE-SR, etc. Either way, while it saves space over multiple adapters, the I/O Virtualization card still needs to cost under $800 at 10 Gigabit to match the costs of buying separate InfiniBand and Ethernet cards. Moreover, the business case depends heavily on which variant of 10 Gigabit Ethernet is in place. A server with mutliple 10GBASE-SR ports is going to offer a lot more opportunity for a lower cost alternative than one with multiple 10GBASE-CX4 ports.

I/O Virtualization can eliminate the practice of one NIC or HBA per virtual machine in a virtualized environment. However, the two major buyers of InfiniBand products, supercomputing centers and financial traders, have done little with server virtualization, and therefore don't stand to benefit greatly from I/O Virtualization.

While there is growing interest in I/O Virtualization, it runs the risk of bumping into some of the cost challenges that have slowed Fibre Channel over Ethernet. Moreover, industries like supercomputing and financial trading are sticking mostly to diverged hardware to obtain the best price/performance. Nonetheless, I/O Virtualization could offer an opportunity to bridge networks at the NIC level instead of at the switch, while still getting some of the price/performance benefits of InfiniBand.

Somehow vendors always want to converge networks just when IT managers are finding new applications for existing technologies. This results in new products banging against unintended uses for established technologies. In turn, vendors create new “convergence” tools to pull everything back together, which then bump up against the IT managers' new applications, and the cycle repeats. This has been a pattern in data networking for at least the last 15 years, where vendor visions of one big happy network have kept colliding with the operating reality of a network that keeps diverging and splitting into new forms and functions. If reality had played out like vendor PowerPoints of years past, we'd all have iSCSI SANs incorporated into IPv6 based-LANs, and Fibre Channel and InfiniBand would be heading to the history books with FDDI and ATM.

Like previous attempts to force networks together, current attempts to do so require expensive hardware. As I pointed out a couple of weeks ago, Fibre Channel over Ethernet looks good when modeled in a PowerPoint network diagram, but not so great when modeled in an Excel cost analysis, with its CNAs still topping $1,500, or about 3x the cost of 10 Gigabit Ethernet server NICs. But this is not the only way to glue disparate networks together, I/O Virtualization can achieve the same thing by using an InfiniBand director to capture all the Ethernet and Fibre Channel traffic.

I/O Virtualization can offer a lower cost/bit at the network level than FCoE, because it can run at up to 20 Gbps. However, I/O Virtualization directors are more expensive than standard InfiniBand directors. Xsigo's VP780, sold through Dell, sells for around $1,000 per DDR port, while a Voltaire (VOLT) 4036E Grid Director costs about $350 per faster QDR port. But this could change quickly once the technology matures.

One major difference in the configuration between standard InfiniBand and I/O Virtualization is that a typical InfiniBand director, such as a Voltaire 4036E, bridges to Ethernet in the switch, while Xsigo consolidates the I/O back at the server NIC. The cost of the additional HCA in the standard InfiniBand configuration is about $300 per port at DDR rates and $600 per port at QDR rates. A 10 Gigabit Ethernet server NIC costs around $500 today, and this price is dropping, although there is some variability based on which 10 Gigabit port type is chosen – CX4, 10GBASE-T, 10 GBASE-SR, etc. Either way, while it saves space over multiple adapters, the I/O Virtualization card still needs to cost under $800 at 10 Gigabit to match the costs of buying separate InfiniBand and Ethernet cards. Moreover, the business case depends heavily on which variant of 10 Gigabit Ethernet is in place. A server with mutliple 10GBASE-SR ports is going to offer a lot more opportunity for a lower cost alternative than one with multiple 10GBASE-CX4 ports.

I/O Virtualization can eliminate the practice of one NIC or HBA per virtual machine in a virtualized environment. However, the two major buyers of InfiniBand products, supercomputing centers and financial traders, have done little with server virtualization, and therefore don't stand to benefit greatly from I/O Virtualization.

While there is growing interest in I/O Virtualization, it runs the risk of bumping into some of the cost challenges that have slowed Fibre Channel over Ethernet. Moreover, industries like supercomputing and financial trading are sticking mostly to diverged hardware to obtain the best price/performance. Nonetheless, I/O Virtualization could offer an opportunity to bridge networks at the NIC level instead of at the switch, while still getting some of the price/performance benefits of InfiniBand.

Labels:

Fibre Channel over Ethernet,

InfiniBand,

VOLT

Wednesday, July 28, 2010

Voltaire Revenue Up 7% Sequentially, 54% Year-over-Year

InfiniBand switch maker Voltaire (VOLT) reported quarterly revenues this morning of $16.6 million, a 54% increase from its 2nd quarter of 2009, and it reaffirmed guidance of $67-70 million for 2010 revenue, reassuring investors who were spooked by Mellanox's (MLNX) downward guidance revision last week.

While it is making every effort to play nice with Ethernet, the company was one of the first to release QDR InfiniBand director and switch ports, which has helped its revenue reverse course off a downward trend it hit during 2008 and 2009.

While it is making every effort to play nice with Ethernet, the company was one of the first to release QDR InfiniBand director and switch ports, which has helped its revenue reverse course off a downward trend it hit during 2008 and 2009.

Labels:

InfiniBand,

VOLT

F5's Market Cap Surpasses Alcatel-Lucent's

The price spike after F5's (FFIV) earnings call last week pushed its market cap over $6.5 billion, surpassing industry stalwart Alcatel-Lucent (ALU), which was at $6.2 billion after yesterday's close. This is an absolutely remarkable development for the networking industry, and shows how important it is to stay focused on industry sub-segments where you're either #1 or #2.

If you think of some of the highest revenue product categories in networking, from core routing to Ethernet switching to 4G wireless, Alcatel-Lucent is in every one of them, while F5 is none of them. So why is its market cap higher?

F5's valuation is a little rich, but certainly not wildly out of control in a 1999 sort of way. It has $780 million of cash and investments, no long-term debt, $40.5 million in net income last quarter, and a $6.9 billion market cap as of yesterday's close. Net of cash this gives the stock a P/E of 38 on annualized earnings, which is lower than its 46% top line growth rate over the last 12 months, and its nearly 90% bottom line growth for the last year.

Excessive optimism is not really the cause of F5 leaping past Alcatel-Lucent, but tremendous focus is. The company does not have an offering in any of the major networking categories, but it is a leader in a growing niche. Alcatel-Lucent, on the other hand, participates in just about every major segment, but leads very few. And its financial reflect this. Its gross margins have been hanging around the low 30s, while F5's have been pushing 80%. While many of the telecom products Alcatel-Lucent offers sell for lower gross margins due to high raw materials costs, Infinera (INFN), which is focused entirely on the low gross margin optical sector, is now posting higher gross margins than Alcatel-Lucent.

Still Recovering from McGinn-Russo

The current challenges at Alcatel-Lucent really have little to do with current management, and in fairness to the new executive team, they have been very focused on reducing overheads and trimming expenses in spite of stereotypes about bloated French bureaucracies. The company's SG&A/Revenue ratio is down to 21%, lower than many of the smaller vendors. Moreover, just 12% of the company's workforce is in France.

Alcatel-Lucent's challenge is the incredibly diverse set of products it must manage, which in part reflects the wild acquisition and over-diversification of the McGinn-Russo era at Lucent, as well as the old school approach of being a supplier who does everything for its telecom customers. This is one reason why its gross margins are low, it has long inventory cycles and must support production and development across a wide range of data, optical, and wireless products. F5, on the other hand, has never tried to have a high "share of wallet", because much of its customers' equipment spending goes to routers and Ethernet switches, neither of which are in its product catalog.

Ten years ago, it was said that startups had no shot at competing against large suppliers like Lucent, Nortel, and Alcatel at major carriers. While this was factually true, it concealed the fact that there was little economic value to being a diversified telco supplier. Even Cisco (CSCO) struggled to break into the carrier market, and scaled back its optical ambitions when its killed its optical switch acquired through Monterrey, and it never even tried to get into 3G or 4G wireless.

Alcatel-Lucent still leads some product categories, notably DSL and Fiber-to-the-Home. Nonetheless, it still needs to trim down its offerings if it wants its market cap to catch up with those vendors generating higher gross margins by offering fewer products.

If you think of some of the highest revenue product categories in networking, from core routing to Ethernet switching to 4G wireless, Alcatel-Lucent is in every one of them, while F5 is none of them. So why is its market cap higher?

F5's valuation is a little rich, but certainly not wildly out of control in a 1999 sort of way. It has $780 million of cash and investments, no long-term debt, $40.5 million in net income last quarter, and a $6.9 billion market cap as of yesterday's close. Net of cash this gives the stock a P/E of 38 on annualized earnings, which is lower than its 46% top line growth rate over the last 12 months, and its nearly 90% bottom line growth for the last year.

Excessive optimism is not really the cause of F5 leaping past Alcatel-Lucent, but tremendous focus is. The company does not have an offering in any of the major networking categories, but it is a leader in a growing niche. Alcatel-Lucent, on the other hand, participates in just about every major segment, but leads very few. And its financial reflect this. Its gross margins have been hanging around the low 30s, while F5's have been pushing 80%. While many of the telecom products Alcatel-Lucent offers sell for lower gross margins due to high raw materials costs, Infinera (INFN), which is focused entirely on the low gross margin optical sector, is now posting higher gross margins than Alcatel-Lucent.

Still Recovering from McGinn-Russo

The current challenges at Alcatel-Lucent really have little to do with current management, and in fairness to the new executive team, they have been very focused on reducing overheads and trimming expenses in spite of stereotypes about bloated French bureaucracies. The company's SG&A/Revenue ratio is down to 21%, lower than many of the smaller vendors. Moreover, just 12% of the company's workforce is in France.

Alcatel-Lucent's challenge is the incredibly diverse set of products it must manage, which in part reflects the wild acquisition and over-diversification of the McGinn-Russo era at Lucent, as well as the old school approach of being a supplier who does everything for its telecom customers. This is one reason why its gross margins are low, it has long inventory cycles and must support production and development across a wide range of data, optical, and wireless products. F5, on the other hand, has never tried to have a high "share of wallet", because much of its customers' equipment spending goes to routers and Ethernet switches, neither of which are in its product catalog.

Ten years ago, it was said that startups had no shot at competing against large suppliers like Lucent, Nortel, and Alcatel at major carriers. While this was factually true, it concealed the fact that there was little economic value to being a diversified telco supplier. Even Cisco (CSCO) struggled to break into the carrier market, and scaled back its optical ambitions when its killed its optical switch acquired through Monterrey, and it never even tried to get into 3G or 4G wireless.

Alcatel-Lucent still leads some product categories, notably DSL and Fiber-to-the-Home. Nonetheless, it still needs to trim down its offerings if it wants its market cap to catch up with those vendors generating higher gross margins by offering fewer products.

Tuesday, July 27, 2010

Cost Effective 10G Data Center Networks

by Lisa Huff

For networks running Gigabit Ethernet, it’s a no-brainer to use Category 5e or 6 cabling with low-cost copper switches for less than 100m connections because they are very reliable and cost about 40-percent less per port than short-wavelength optical ones. But for 10G, there are other factors to consider.

While 10GBASE-T ports are now supposedly available on switches (at least the top Ethernet switch vendors, Brocade, Cisco and Extreme Networks say they have them), is it really more cost effective to use these instead of 10GBASE-SR, 10GBASE-CX4 or 10GBASE-CR (SFP+ direct attach copper)? Well, again, it depends on what your network looks like and how well your data center electrical power and cooling structures are designed.

First, 10GBASE-CX4 is really a legacy product and is only available on a limited number of switches so you may want to rule this out right away. If you’re looking for higher density, but you can’t support too many higher power devices, I would opt for 10GBASE-SR because it has the lowest power consumption – usually less than 1W/port. And also, the useful life of LOMF is longer; it’s smaller so won’t take up as much space or block cooling airflow if installed under a raised floor.

If you don’t have a power or density problem and can make do with just a few 10G ports for a short distance, you may choose to use 10GBASE-CR (about $615/port). But, if you don’t have a power or density issue and you need to go longer than about 10m, you’ll still need to use 10GBASE-SR and if you need a reach of more than 300m you’ll need to either install OM4 cable (which will get you up to 600m in some cases) to use with your SR devices; or look at 10GBASE-LR modules ($2500/port) that will cost you about twice as much as the SR transceivers (about $1300/port). If your reach needs to be less than 100m and you can afford higher power, but you need the density, 10GBASE-T (<$500/port) may be your solution. If you have a mix of these requirements, you may want to make sure you opt for an SFP-based switch so you can mix long and short reaches and copper and fiber modules/cables for maximum flexibility.

So what’s the bottom line? Do an assessment of your needs in your data center (and the rest of your network for that matter) and plan them out in order to maximize the cost effectiveness of your 10G networks. One more thing – if you can wait a few months, you may want to consider delaying implementation of 10G until later this year when most of the 10GBASE-T chip manufacturers promise to have less than 2.5W devices commercially available, which will drastically reduce (about half) its per port power consumption.

For networks running Gigabit Ethernet, it’s a no-brainer to use Category 5e or 6 cabling with low-cost copper switches for less than 100m connections because they are very reliable and cost about 40-percent less per port than short-wavelength optical ones. But for 10G, there are other factors to consider.

While 10GBASE-T ports are now supposedly available on switches (at least the top Ethernet switch vendors, Brocade, Cisco and Extreme Networks say they have them), is it really more cost effective to use these instead of 10GBASE-SR, 10GBASE-CX4 or 10GBASE-CR (SFP+ direct attach copper)? Well, again, it depends on what your network looks like and how well your data center electrical power and cooling structures are designed.

First, 10GBASE-CX4 is really a legacy product and is only available on a limited number of switches so you may want to rule this out right away. If you’re looking for higher density, but you can’t support too many higher power devices, I would opt for 10GBASE-SR because it has the lowest power consumption – usually less than 1W/port. And also, the useful life of LOMF is longer; it’s smaller so won’t take up as much space or block cooling airflow if installed under a raised floor.

If you don’t have a power or density problem and can make do with just a few 10G ports for a short distance, you may choose to use 10GBASE-CR (about $615/port). But, if you don’t have a power or density issue and you need to go longer than about 10m, you’ll still need to use 10GBASE-SR and if you need a reach of more than 300m you’ll need to either install OM4 cable (which will get you up to 600m in some cases) to use with your SR devices; or look at 10GBASE-LR modules ($2500/port) that will cost you about twice as much as the SR transceivers (about $1300/port). If your reach needs to be less than 100m and you can afford higher power, but you need the density, 10GBASE-T (<$500/port) may be your solution. If you have a mix of these requirements, you may want to make sure you opt for an SFP-based switch so you can mix long and short reaches and copper and fiber modules/cables for maximum flexibility.

So what’s the bottom line? Do an assessment of your needs in your data center (and the rest of your network for that matter) and plan them out in order to maximize the cost effectiveness of your 10G networks. One more thing – if you can wait a few months, you may want to consider delaying implementation of 10G until later this year when most of the 10GBASE-T chip manufacturers promise to have less than 2.5W devices commercially available, which will drastically reduce (about half) its per port power consumption.

Labels:

10 Gigabit

Monday, July 26, 2010

Savvis Revenue Up 1% year-over-year, raises EBITDA guidance

by David Gross

This morning, Savvis (SVVS) reported revenue of $221 million for the quarter, and raised its annual EBITDA guidance from $210-$225 million, to $220-$240 million.

Operating cash flow was $32 million, free cash -$19 million. The company has over $700 million of debt, some of which came from financing its recent acquisiton of Fusepoint.

Managed services are slowly catching up to colocation, with quarterly revenue climbing to $73 milion from $67 million in the year ago quarter, while colo has held steady at $84 million.

All in all, no big surprises.

This morning, Savvis (SVVS) reported revenue of $221 million for the quarter, and raised its annual EBITDA guidance from $210-$225 million, to $220-$240 million.

Operating cash flow was $32 million, free cash -$19 million. The company has over $700 million of debt, some of which came from financing its recent acquisiton of Fusepoint.

Managed services are slowly catching up to colocation, with quarterly revenue climbing to $73 milion from $67 million in the year ago quarter, while colo has held steady at $84 million.

All in all, no big surprises.

Labels:

SVVS

SFP+ Marks a Shift in Data Center Cabling

by Lisa Huff

With the advent of top-or-rack (ToR) switching and SFP+ direct attach copper cables, more data centers are able to quickly implement cost-effective 10G and beyond connections. ToR designs are currently one of two configurations:

1. GigE Category cabling (CAT5e, 6, or 6A) connection to each server with a 10G SFP+ or XFP uplink to either an EoR switch or back to a switch in the main distribution area (MDA)

2. SFP direct attach cabling connection to each server with a 10G SFP+ or XFP uplink to either an EoR switch or back to a switch in the MDA

Either way, SFP and SFP+ modules and cable assemblies are starting to see huge inroads where Category cabling used to be the norm. Consequently, structured cabling companies have taken their shot at offering the copper variants of these devices. Panduit was one of the first that offered an SFP direct-attach cable for the data center, but Siemon quickly followed suit and surpassed Panduit by offering both the copper and optical versions of the assemblies as well as the parallel optics QSFP+ AOC. Others rumored of working on entering into this market are Belden (BDC) and CommScope (CTV). This really marks a shift in philosophy for these companies who traditionally have stayed away from what they considered “interconnect” products. There are a couple of notable exceptions in Tyco Electronics and Molex that have both types of products, however.

So what makes these companies believe they can compete with the likes of Amphenol Interconnect (APH), Molex (MOLX) and Tyco Electronics (TEL)? Well, it might not be the fact that they think they can compete, but that they see some erosion of their patch cord businesses and view this as the only way to make sure the “interconnect” companies don’t get into certain customers. So, protecting their customer base by offering products they won’t necessarily make any money on – because, after all, many of them are actually private-labeled from the very companies they are trying to oust. Smart or risky? Smart, I think, because it seems to me that the future of the data center will be in short-reach copper and mid-range fiber in the form of laser-optimized multi-mode fiber (LOMF).

With the advent of top-or-rack (ToR) switching and SFP+ direct attach copper cables, more data centers are able to quickly implement cost-effective 10G and beyond connections. ToR designs are currently one of two configurations:

1. GigE Category cabling (CAT5e, 6, or 6A) connection to each server with a 10G SFP+ or XFP uplink to either an EoR switch or back to a switch in the main distribution area (MDA)

2. SFP direct attach cabling connection to each server with a 10G SFP+ or XFP uplink to either an EoR switch or back to a switch in the MDA

Either way, SFP and SFP+ modules and cable assemblies are starting to see huge inroads where Category cabling used to be the norm. Consequently, structured cabling companies have taken their shot at offering the copper variants of these devices. Panduit was one of the first that offered an SFP direct-attach cable for the data center, but Siemon quickly followed suit and surpassed Panduit by offering both the copper and optical versions of the assemblies as well as the parallel optics QSFP+ AOC. Others rumored of working on entering into this market are Belden (BDC) and CommScope (CTV). This really marks a shift in philosophy for these companies who traditionally have stayed away from what they considered “interconnect” products. There are a couple of notable exceptions in Tyco Electronics and Molex that have both types of products, however.

So what makes these companies believe they can compete with the likes of Amphenol Interconnect (APH), Molex (MOLX) and Tyco Electronics (TEL)? Well, it might not be the fact that they think they can compete, but that they see some erosion of their patch cord businesses and view this as the only way to make sure the “interconnect” companies don’t get into certain customers. So, protecting their customer base by offering products they won’t necessarily make any money on – because, after all, many of them are actually private-labeled from the very companies they are trying to oust. Smart or risky? Smart, I think, because it seems to me that the future of the data center will be in short-reach copper and mid-range fiber in the form of laser-optimized multi-mode fiber (LOMF).

Labels:

cabling,

Optical Components

Saturday, July 24, 2010

DLR Revenue in Line, FFO Comes Up Short

by David Gross

We'll have more on this, but the Digital Realty (DLR) call was slightly disappointing, with FFO coming in at 76 cents, compared to estimates of 83 cents. The REIT also cut FFO guidance for the year from $3.47 to a range of $3.24 to $3.32.

Revenue was up 27% year-over-year to $197 million.

We'll have more on this, but the Digital Realty (DLR) call was slightly disappointing, with FFO coming in at 76 cents, compared to estimates of 83 cents. The REIT also cut FFO guidance for the year from $3.47 to a range of $3.24 to $3.32.

Revenue was up 27% year-over-year to $197 million.

Labels:

Data Center REITs,

DLR

Friday, July 23, 2010

Does Mellanox Know How it Will Grow?

by David Gross

This week, Mellanox (MLNX) joined the list of data center hardware suppliers reporting double digit year-over-year revenue growth. Its top line grew 58% annually to $40 million this past quarter. However, unlike F5 Networks (FFIV) and EMC (EMC), which both guided up for their next reporting periods, Mellanox announced that it expected revenue to decline about 7% sequentially in the third quarter. While it claimed things should turn around in the 4th quarter, the stock was down 25% soon after the announcement.

The company claims that the reason for the temporary decline is a product shift to silicon and away from boards and host channel adapters. This represents a sharp reversal of the trend it saw for much of 2009, when adapter revenue grew while silicon revenue dropped. Given the timing of its 40/100 Gigabit and LAN-on-Motherboard product cycles, this trend could keep going back and forth in the future, which has a big impact on revenue because individual adapters sell for roughly ten times the price of individual semiconductors.

While investors reacted swiftly to the revenue announcement, a bigger concern is not the shifting revenue among product components, but the company's apparent lack of faith in the InfiniBand market is dominates. InfiniBand is a growing, high-end, niche technology. Among the world's 500 largest supercomputers, 42% use InfiniBand as their interconnect between server nodes. Two years ago, only 24% did, according to Top500.org. But InfiniBand's success in supercomputing has yet to translate into major wins in traditional data centers, where it runs into the mass of existing Ethernet switches.

The company's response, developed in conjunction with the InfiniBand Trade Association it is heavily involved with, has been to develop RDMA over Converged Ethernet, or RoCE, pronounced liked the character Sylvester Stallone played in the 70s and 80s. In many respects, RoCE is InfiniBand-over-Ethernet, it uses InfiniBand networking technologies, but slides them into Ethernet frames. Traditionally, pricing for one link technology over another has not been competitive, because low volume multi-protocol boards require more silicon and design work than single protocol equivalents. This has been seen in the more widely promoted Fibre Channel-over-Ethernet, where Converged Network Adapters based on that technology are still selling for about three times the price of standard 10 Gigabit Ethernet server NICs.

By investing in RoCE, Mellanox is basically saying InfiniBand will not be able to stimulate demand on its own in the data center, even though it offers remarkable price/performance in supercomputing clusters. Moreover, there is still plenty of opportunity for InfiniBand to have an impact as IT mangers begin to look at 40 Gigabit alternatives. But just as the company cannot seem to figure out if growth will come for adapter cards or silicon, its now going against its push for RoCE by touting a Google engineering presentation that highlighted the benefits of running pure InfiniBand in a data center network.

Mellanox has long been a high margin company with a dominant position in a niche technology, and its strong balance sheet reflects this heritage. And the stock's recent pummeling has sent the company's valuation down to just 2.5 times cash. But by sending out so many conflicting messages about chips vs. cards and InfiniBand vs. Ethernet, the question is not whether investors have confidence in the company's growth plans, but whether management does.

This week, Mellanox (MLNX) joined the list of data center hardware suppliers reporting double digit year-over-year revenue growth. Its top line grew 58% annually to $40 million this past quarter. However, unlike F5 Networks (FFIV) and EMC (EMC), which both guided up for their next reporting periods, Mellanox announced that it expected revenue to decline about 7% sequentially in the third quarter. While it claimed things should turn around in the 4th quarter, the stock was down 25% soon after the announcement.

The company claims that the reason for the temporary decline is a product shift to silicon and away from boards and host channel adapters. This represents a sharp reversal of the trend it saw for much of 2009, when adapter revenue grew while silicon revenue dropped. Given the timing of its 40/100 Gigabit and LAN-on-Motherboard product cycles, this trend could keep going back and forth in the future, which has a big impact on revenue because individual adapters sell for roughly ten times the price of individual semiconductors.

While investors reacted swiftly to the revenue announcement, a bigger concern is not the shifting revenue among product components, but the company's apparent lack of faith in the InfiniBand market is dominates. InfiniBand is a growing, high-end, niche technology. Among the world's 500 largest supercomputers, 42% use InfiniBand as their interconnect between server nodes. Two years ago, only 24% did, according to Top500.org. But InfiniBand's success in supercomputing has yet to translate into major wins in traditional data centers, where it runs into the mass of existing Ethernet switches.

The company's response, developed in conjunction with the InfiniBand Trade Association it is heavily involved with, has been to develop RDMA over Converged Ethernet, or RoCE, pronounced liked the character Sylvester Stallone played in the 70s and 80s. In many respects, RoCE is InfiniBand-over-Ethernet, it uses InfiniBand networking technologies, but slides them into Ethernet frames. Traditionally, pricing for one link technology over another has not been competitive, because low volume multi-protocol boards require more silicon and design work than single protocol equivalents. This has been seen in the more widely promoted Fibre Channel-over-Ethernet, where Converged Network Adapters based on that technology are still selling for about three times the price of standard 10 Gigabit Ethernet server NICs.

By investing in RoCE, Mellanox is basically saying InfiniBand will not be able to stimulate demand on its own in the data center, even though it offers remarkable price/performance in supercomputing clusters. Moreover, there is still plenty of opportunity for InfiniBand to have an impact as IT mangers begin to look at 40 Gigabit alternatives. But just as the company cannot seem to figure out if growth will come for adapter cards or silicon, its now going against its push for RoCE by touting a Google engineering presentation that highlighted the benefits of running pure InfiniBand in a data center network.

Mellanox has long been a high margin company with a dominant position in a niche technology, and its strong balance sheet reflects this heritage. And the stock's recent pummeling has sent the company's valuation down to just 2.5 times cash. But by sending out so many conflicting messages about chips vs. cards and InfiniBand vs. Ethernet, the question is not whether investors have confidence in the company's growth plans, but whether management does.

Labels:

EMC,

FFIV,

InfiniBand,

MLNX

Thursday, July 22, 2010

QLogic Revenue Up 16% Year-over-Year, But Reduces Next Qtr Guidance

by David Gross

QLogic (QLGC) had a strong quarter, growing its top line 16% from a year ago to $143 million. However it's getting hit in after hours trading as it took revenue guidance down for next quarter from $150 million to a range of $143 million to $147 million. It's not getting beaten as badly as rival Mellanox (MLNX), which fell 32% today after guiding for a 7% sequential revenue decline, but it's down about 11% off this news from the earnings call.

QLogic (QLGC) had a strong quarter, growing its top line 16% from a year ago to $143 million. However it's getting hit in after hours trading as it took revenue guidance down for next quarter from $150 million to a range of $143 million to $147 million. It's not getting beaten as badly as rival Mellanox (MLNX), which fell 32% today after guiding for a 7% sequential revenue decline, but it's down about 11% off this news from the earnings call.

Top-of-Rack (ToR) Switching – Better or Worse for Your Data Center?

by Lisa Huff

Earlier this month I talked about how ToR switching has become popular in the data center and how large switch manufacturers are telling you that it’s really the only way to implement 10G Ethernet. I left that post with this question – “But is it the best possible network architecture for the data center?” And, I promised to get back to you with some assessments.

The answer, of course, is that it depends. Mainly, it depends on what you’re trying to achieve. There are many considerations when moving to this topology. Here are just a few:

2) Cost 2: While the installation of the structured cabling is expensive, if you choose the latest and greatest like CAT6A or CAT7 for copper and OM3 or OM4 for fiber, it typically lasts at least 10 years and could last longer. It can stay there for at least two and possibly three network equipment upgrades. How often do you think you’ll need to replace your ToR switches? Probably every three-to-five years.

3) Cost 3: Something most data center managers haven’t considered – heat. I’ve visited a couple of data centers that have implemented ToR switching only to see that after about a month, some of the ports were seeing very high BER’s to the point where they would fail. What was happening is that the switch is deeper than the servers that are stacked below it and was trapping the exhaust heat at the top of the rack where some “questionable” patch cords were being used. This heat caused out-of-spec insertion loss on these copper patch cords and therefore bit errors.

4) Cost 4: More switch ports than you can actually use within a rack. Some people call this oversubscription. My definition (and the industry’s) for oversubscription is just the opposite so I will not use this term. But, the complaint is this – cabinets are typically 42U or 48U. Each server, if you’re using pizza-box servers, are 1U or 2U. You need a UPS, which is typically 2U or 4U and your ToR switch takes up 1U or 2U. So, the maximum amount of servers you can have in a rack would realistically be 40. Most data centers have much less than this – around 30. In order to connect all of these servers to a ToR switch, you would need a 48-port switch. So you’re paying for eighteen ports that you will most likely never use. Or, what I’ve seen happen sometimes, is that data center managers want to use these extra ports so they connect them to servers in the next cabinet – now you have a cabling nightmare.

So I’ve listed some of the downside. In a future post, I’ll give you some advantages of ToR switching.

Labels:

Ethernet,

InfiniBand

Wednesday, July 21, 2010

Mellanox Revenue up 58% year-over year, F5 up 46% UPDATED

Mellanox (MLNX) and F5 (FFIV), both dependent on data centers and HPC both reported strong revenue growth today, with Mellanox's top line up 10% sequentially and 58% year-over-year, and F5 up 12% sequential and 46% y/y. But the similarities end there. Mellanox guided for a 7% revenue decline next quarter due to product mix, while F5 guided up, 5% past current estimates. After hours trading reflected these two very different outlooks for the upcoming quarter.

Mellanox blamed a shift in product mix from boards to chips, as it ramps up volumes of its silicon for LAN-on-Motherboard cards, which sell for far less than its InfiniBand HCAs. Still, InfiniBand's share of Top500 Supercomputing interconnects is rising, from 30% in June 2009 to 36% in November 2009 to 42% in June 2010. If this business is all going to QLogic (QLGC), we'll find out tomorrow, when that supplier reports.

Mellanox blamed a shift in product mix from boards to chips, as it ramps up volumes of its silicon for LAN-on-Motherboard cards, which sell for far less than its InfiniBand HCAs. Still, InfiniBand's share of Top500 Supercomputing interconnects is rising, from 30% in June 2009 to 36% in November 2009 to 42% in June 2010. If this business is all going to QLogic (QLGC), we'll find out tomorrow, when that supplier reports.

Common Electrical Interface for 25/28G - Possibility or Pipe Dream?

by Lisa Huff

Monday, I sat through a workshop hosted by the Optical Interconnecting Forum (OIF) on its “Common Electrical Interface (CEI) project for 28G Very Short Reach (VSR).” What quickly became clear to me was that I was in a room of VERY optimistic engineers.

I sat through presentations that were characterized as “Needs of the Industry,” which consisted of content from the leaders of IEEE 802.3ba (40/100G Ethernet), T11.2 (Fibre Channel) and InfiniBand standards groups. Yet all of these representatives made sure they carefully stated that what they were presenting was their own opinions and not that of their standards groups, which I found odd since most of what they showed was directly from the standards. Legalities I guess. I also noticed that they never really sited any kind of independent market research or analysis of what the “needs of the industry” were. For instance, one speaker said that InfiniBand has a need for 26AWG, 3-meter copper cable assemblies for 4x25G operation in order to keep the cost down within a cabinet. Yet, he did not present any data or even mention what customers are asking for this. Maybe this exists, but to me unless it is presented, the case for it is weak. I do have evidence directly from some clustering folks that they are moving away from copper in favor of fiber for many reasons – lower power consumption, weight of cabling, higher density, and room in cabinets, pathways and spaces.

Today, data center managers are really still just starting to realize the benefits of deploying 10G, which has yet to reach its market potential. I understand that standards groups must work on future data rates ahead of broad market demands, but this seems extremely premature. None of the current implementations for 40/100G that use 10G electrical signaling have even been deployed yet (except for maybe a few InfiniBand ones). And, from what I understand from at least one chip manufacturer who sells a lot of 10G repeaters to OEMs for their backplanes, it is difficult enough to push 10G across a backplane or PCB. Why wouldn’t the backplane and PCB experts solve this issue that is here today before they move onto trying to solve a “problem” that doesn’t even exist yet?

Maybe they need to revisit optical backplanes for 25G? It seems to me that 25G really won't be needed any time soon and that their time would be better spent on developing something that would appear to have relevancy beyond 25G. To me, designing some exotic DSP chip that would allow 25G signals to be transmitted over four-to-12 inches of PCB and maybe 3m of copper cable for one generation of equipment may not be very productive. Maybe this is simpler than I anticipate, but then again, there was a similar but a little more complicated problem with 10GBASE-T and look how that turned out...

Labels:

10 Gigabit,

100 Gigabit,

40 Gigabit,

Ethernet,

Optical Components,

Semiconductors

Tuesday, July 20, 2010

40/100G – A Major Shift to Parallel Optics?

by Lisa Huff

Parallel-optics have been around for more than a decade – remember SNAP12 and POP4? These were small 12 and four-fiber parallel-optics modules that were developed for telecom VSR applications. They never really caught on for Ethernet networks though. Other than a few CWDM solutions, volume applications for datacom transceivers have been serial short-wavelength ones. At 40G, this is changing.High performance computing (HPC) centers have already adopted parallel optics at 40 and 120G using InfiniBand (IB) 4x and 12x DDR. And, they are continuing this trend through their next data rate upgrades – 80 and 240G. While in the past I thought of HPC as a small, somewhat niche market, I now think this is shifting due to two major trends:

- IB technology has crossed over into 40 and 100-Gigabit Ethernet in the form of both active optical cable assemblies, CFP and CXP modules.

- More and more medium-to-large enterprise data centers are starting to look like HPC clusters with masses of parallel processing

Once parallel-optics based transceivers are deployed for 40/100G networks, will we ever return to serial transmission?

Labels:

100 Gigabit,

InfiniBand,

Optical Components,

Supercomputing

Monday, July 19, 2010

Updated July-August Earnings Calendar

Earnings season starts today for data center stocks, here's the latest calendar...

IBM July 19

IBM July 19

VMW July 20

ALTR July 20

APH July 21

ALTR July 20

APH July 21

EMC July 21

FFIV July 21

XLNX July 21

XLNX July 21

MLNX July 22

QLGC July 22

QLGC July 22

RVBD July 22

DLR July 23

SVVS July 26 10am

LVLT July 27 10am

BRCM July 27

RDWR July 27

RDWR July 27

VOLT July 28 10am

AKAM July 28

EQIX July 28

LSI July 28

NETL July 28

BDC July 29

EXTR Aug 2

LSI July 28

NETL July 28

BDC July 29

EXTR Aug 2

RAX Aug 2

EMR Aug 3

EMR Aug 3

DFT Aug 4 (release on Aug 3)

INAP Aug 4

TMRK Aug 4

CRAY Aug 4

CRAY Aug 4

LLNW Aug 5

ELX Aug 5

SGI Aug 6

ELX Aug 5

SGI Aug 6

CSCO Aug 11

DELL Aug 19

HPQ Aug 19

BCSI Aug 20

HPQ Aug 19

BCSI Aug 20

Friday, July 16, 2010

Network Utilization Has Nothing to do with Upgrading Bandwidth

by David Gross

One of the questions I've been asked by hedge funds is whether networks are full enough to justify upgrades to 40 or 100 gigabit, as if communications networks are like airplanes or railcars, and only need to be expanded if they're already full. But this misses the point of why upgrades beyond 10 gigabit are needed, especially in the data center, where it's long been possible to provision 10 gigabit links for much less cost than longer reach 1 gigabit connections in telecom networks.

Financial professionals more than anyone should understand the upgrade past 10 gigabit is primarily about latency, not bandwidth. And one of the primary contributors to latency, serialization delay, drops proportionally to increases in line rate. A 1500 byte packet, for example, has a 1.2 microsecond delay at 10 Gbps, but a .3 microsecond, or 300 nanosecond, delay at 40 Gbps. With financial services, one of the leading buyers of high capacity switches, the upgrade is therefore cost justified by the value of reducing execution times by 900 nanoseconds, which is far more than the cost of a new switch for many firms. None of this has anything to do with whether the existing network peaks at 10% utilization during the day, or at 60%.

Even in longer-reach networks, upgrades are tied to revenue, not just network utilization. When AT&T (T) upgraded its MPLS core to 40G, it included nine out-of-region markets where it did not offer U-Verse or any video service. The financial justification was to maintain low latency for commercial customers whose traffic was riding that MPLS networks, many of whom spend tens of thousands a month with the carrier.

Bandwidth is often described as a faster link or fatter pipe, the latter might make sense when talking about consumer video, but no one's getting 40 or 100 gigabits to their home anytime soon. In data centers and even long-reach corporate networks, it makes more sense to think of upgrades in terms of raw speed, because a faster path, not a wider lane, is essential when you're trying to make a quick trade.

One of the questions I've been asked by hedge funds is whether networks are full enough to justify upgrades to 40 or 100 gigabit, as if communications networks are like airplanes or railcars, and only need to be expanded if they're already full. But this misses the point of why upgrades beyond 10 gigabit are needed, especially in the data center, where it's long been possible to provision 10 gigabit links for much less cost than longer reach 1 gigabit connections in telecom networks.

Financial professionals more than anyone should understand the upgrade past 10 gigabit is primarily about latency, not bandwidth. And one of the primary contributors to latency, serialization delay, drops proportionally to increases in line rate. A 1500 byte packet, for example, has a 1.2 microsecond delay at 10 Gbps, but a .3 microsecond, or 300 nanosecond, delay at 40 Gbps. With financial services, one of the leading buyers of high capacity switches, the upgrade is therefore cost justified by the value of reducing execution times by 900 nanoseconds, which is far more than the cost of a new switch for many firms. None of this has anything to do with whether the existing network peaks at 10% utilization during the day, or at 60%.

Even in longer-reach networks, upgrades are tied to revenue, not just network utilization. When AT&T (T) upgraded its MPLS core to 40G, it included nine out-of-region markets where it did not offer U-Verse or any video service. The financial justification was to maintain low latency for commercial customers whose traffic was riding that MPLS networks, many of whom spend tens of thousands a month with the carrier.

Bandwidth is often described as a faster link or fatter pipe, the latter might make sense when talking about consumer video, but no one's getting 40 or 100 gigabits to their home anytime soon. In data centers and even long-reach corporate networks, it makes more sense to think of upgrades in terms of raw speed, because a faster path, not a wider lane, is essential when you're trying to make a quick trade.

Labels:

10 Gigabit,

100 Gigabit,

40 Gigabit,

AT and T

Thursday, July 15, 2010

Is Data Center Structured Cabling Becoming Obsolete?

by Lisa Huff

Today if you walk into a “typical” data center you’ll see tons of copper Category cabling in racks, under the raised floor and above cabinets. Of course, it can be argued that there is no such thing as a “typical” data center. But, regardless, most of them still have a majority of copper cabling – but that’s starting to change. Over the last year, we’ve seen the percentage of copper cabling decrease from about 90-percent to approximately 80-percent and according to several data center managers I’ve spoken to lately, they would go entirely fiber if they could afford to.

Well, at 10G, they may just get their wish. Not on direct cost, but perhaps on operating or indirect costs. While copper transceivers at Gigabit data rates cost less than $5 per port (for the switch manufacturer), short wavelength optical ones still hover around $20/port (for the switch manufacturer) and about $120/port for the end user – a massive markup we’ll explore later. But 10GBASE-T ports are nearly non-existent – for many reasons, but the overwhelming one is power consumption. 10GBASE-SR ports with SFP+ modules are now available that consume less than 1W of power, while 10G copper chips are struggling to meet a less than 4W requirement. Considering the fact that power and cooling densitie4s are increasingly issues for data center managers, this alone may steer them to fiber.

This has also led to interconnect companies like Amphenol (APH), Molex (MOLX) and Tyco Electronics (TEL) to take advantage of their short-reach copper twinax technology in the form of the SFP+ direct attach cable assemblies and a change in network topology – away from structured cabling. So while structured cabling may be a cleaner and more flexible architecture, many have turned to top-of-rack switching and direct-connect cabling just so they can actually implement 10-Gigabit Ethernet. Of course, Brocade (BRCD), Cisco (CSCO), Force10 and others support this change because they sell more equipment. But is it the best possible network architecture for the data center?

Labels:

BRCD,

cabling,

CSCO,

Optical Components

Wednesday, July 14, 2010

How Rackspace Saved the Managed Hosting Industry

by David Gross

Since the USinternetworking bankruptcy in 2001, there has been a lot of skepticism about the managed hosting business. It squeezes in between the more asset heavy collocation industry, and the more people heavy Software-as-a-Service industry. This requires that managed hosters walk a financial tightrope between wrecking the balance sheet with too many fixed asset purchases, or destroying the income statement by hiring too many people.

Before the USinternetworking story ended at chapter 11, there were clear warning signs of trouble with the company that were evident in its asset utilization and employee productivity ratios. It had a .48 Revenue/PP&E ratio, and just $95,000 of revenue per employee. Essentially, it was trying to be capital-intensive and labor-intensive at the same time. In addition to the dot com bust, this sent everyone scrambling away from the managed services market, and left it as a side service for collocation providers and telecom carriers, except for one company that decided to focus on it - Rackspace (RAX).

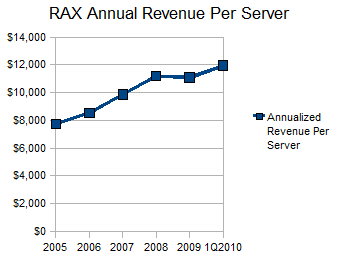

Rackspace has carefully managed both its asset utilization and employee productivity to the point that its EBITDA margins now top 30%, which is remarkable considering how this type of service was once seen as a one-way ticket to bankruptcy court. The company's 1.59 Revenue/PP&E ratio is among the highest outside of the REITs and co-lo providers. Moreover, its revenue per server has been increasing from $7,700 to 2005 to nearly $12,000 today.

The most important thing the company has done to achieve its high asset utilization has been to stay out of the unmanaged collocation business. Specifically, this has produced three major benefits:

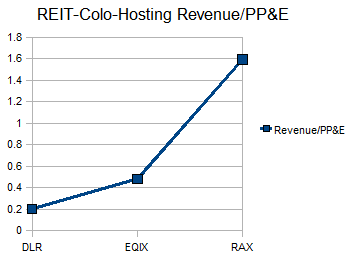

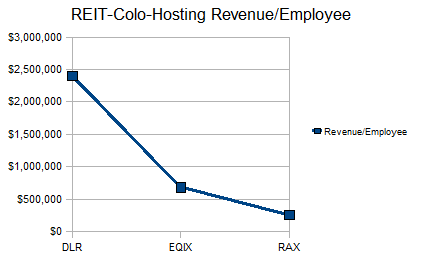

The financial benefits of sticking to managed services for Rackspace have been similar to the financial benefits Equinix (EQIX) has seen from sticking to unmanaged services, and that Digital Realty (DLR) has seen from being a simple REIT. This is best seen in each company's asset and employee utilization ratios, which are vastly different for each.

As you can see, the asset and employee utilization numbers for each company differ significantly, which is why these services do not mix well under one corporate entity. Rackspace's cloud service has not resulted in over-diversification for the company, because it runs at similar revenue/employee and revenue/asset ratios to the traditional hosting service, and it allows the company to use idle capacity in existing servers.

In addition to stronger balance sheet and income statement ratios, these focused providers have also seen higher revenue growth over the last year, as other competitors sort out which services they do and do not want to offer. Nonetheless, it does not take deep technical knowledge to succeed in this business, just a simple understanding of how to choose between spending on people or spending on assets.

Since the USinternetworking bankruptcy in 2001, there has been a lot of skepticism about the managed hosting business. It squeezes in between the more asset heavy collocation industry, and the more people heavy Software-as-a-Service industry. This requires that managed hosters walk a financial tightrope between wrecking the balance sheet with too many fixed asset purchases, or destroying the income statement by hiring too many people.

Before the USinternetworking story ended at chapter 11, there were clear warning signs of trouble with the company that were evident in its asset utilization and employee productivity ratios. It had a .48 Revenue/PP&E ratio, and just $95,000 of revenue per employee. Essentially, it was trying to be capital-intensive and labor-intensive at the same time. In addition to the dot com bust, this sent everyone scrambling away from the managed services market, and left it as a side service for collocation providers and telecom carriers, except for one company that decided to focus on it - Rackspace (RAX).

Rackspace has carefully managed both its asset utilization and employee productivity to the point that its EBITDA margins now top 30%, which is remarkable considering how this type of service was once seen as a one-way ticket to bankruptcy court. The company's 1.59 Revenue/PP&E ratio is among the highest outside of the REITs and co-lo providers. Moreover, its revenue per server has been increasing from $7,700 to 2005 to nearly $12,000 today.

The most important thing the company has done to achieve its high asset utilization has been to stay out of the unmanaged collocation business. Specifically, this has produced three major benefits:

- The company has not been forced to build data centers near its customers, it's left the mad scramble for space in Northern New Jersey to the collocation providers, who have to be there for their financial customers

- It has had the resources to expand into cloud hosting, which offers growth opportunities, but significant financial risk for the provider that must both staff up and construct new facilities at the same time

- It has achieved better volume discounts from suppliers, by saving 2/3rds of its capital budget for customer servers and equipment, not new buildings

The financial benefits of sticking to managed services for Rackspace have been similar to the financial benefits Equinix (EQIX) has seen from sticking to unmanaged services, and that Digital Realty (DLR) has seen from being a simple REIT. This is best seen in each company's asset and employee utilization ratios, which are vastly different for each.

As you can see, the asset and employee utilization numbers for each company differ significantly, which is why these services do not mix well under one corporate entity. Rackspace's cloud service has not resulted in over-diversification for the company, because it runs at similar revenue/employee and revenue/asset ratios to the traditional hosting service, and it allows the company to use idle capacity in existing servers.

In addition to stronger balance sheet and income statement ratios, these focused providers have also seen higher revenue growth over the last year, as other competitors sort out which services they do and do not want to offer. Nonetheless, it does not take deep technical knowledge to succeed in this business, just a simple understanding of how to choose between spending on people or spending on assets.

Labels:

Managed Hosting,

RAX

Tuesday, July 13, 2010

Why TCO Models Fail

by David Gross

For years, data center and telecom suppliers have presented TCO models to customers promising a full range of financial benefits, from lower operating costs to more revenue to reduced capex. But they're not taken very seriously. Understanding that these payback scenarios are often created by engineers with limited financial knowledge, some companies will venture out to a large consulting firm that itself has limited product knowledge in order to validate some of their claims. But the result is the same, a McKinsey or Bain mark on a spreadsheet does little to add credibility to numbers that no financial analyst with budget responsibility can take seriously.

The reason these business cases fail include:

In addition to ignoring these financial realities, many business cases get tossed in the trash because they show no understanding of operational realities. This often occurs with the clever models put together by MBA consulting firms with little industry experience. I once saw a business case that showed new revenue amazingly appearing with the purchase of a new switch. What was not shown was any recognition of time needed to sell the 150 gigabit+ capacity within the switch, to negotiate large bandwidth purchases, network planning, circuit ordering, credit checks, or any of the typical issues that come up with major network capacity issues. Adding in reasonable operating expectations for filling capacity threw the IRR under many companies' cost of capital, and made buying the switch a bad deal – per the supplier's own business case.

Having survived two bruising recessions in the last decade, purchasing managers will not go to bat for a vendor that cannot show the financial depth that the finance department needs, or operational understanding that puts credibility behind any financial projections. With so many cost-of-ownership and payback models ending up as a big waste of time and effort, smart hardware suppliers need to reconsider how they present the financial justification for buying their equipment.

For years, data center and telecom suppliers have presented TCO models to customers promising a full range of financial benefits, from lower operating costs to more revenue to reduced capex. But they're not taken very seriously. Understanding that these payback scenarios are often created by engineers with limited financial knowledge, some companies will venture out to a large consulting firm that itself has limited product knowledge in order to validate some of their claims. But the result is the same, a McKinsey or Bain mark on a spreadsheet does little to add credibility to numbers that no financial analyst with budget responsibility can take seriously.

The reason these business cases fail include:

- Scattered Financial Benefits – most financially worthwhile products cut capex, increase productivity, or add to revenue, but not all three

- Automatic Layoffs at Installation – operations staff are often modeled to disappear after a new router or switch is installed, this of course never happens in practice, a more sensible way to present this is to demonstrate that your product can improve productivity, not that it cuts opex

- No Time Value of Money - many engineers and product managers will say “ROI” 100 times without ever showing an IRR, or Internal Rate of Return, on the capital outlay of buying their product. A 15% “ROI” is pretty good if it occurs over 8 months and will beat just about any buyer's cost of capital, but it is dreadful if it occurs over 3 years - the IRR at 8 months is about 23%, while at 3 years it's about 4%.

In addition to ignoring these financial realities, many business cases get tossed in the trash because they show no understanding of operational realities. This often occurs with the clever models put together by MBA consulting firms with little industry experience. I once saw a business case that showed new revenue amazingly appearing with the purchase of a new switch. What was not shown was any recognition of time needed to sell the 150 gigabit+ capacity within the switch, to negotiate large bandwidth purchases, network planning, circuit ordering, credit checks, or any of the typical issues that come up with major network capacity issues. Adding in reasonable operating expectations for filling capacity threw the IRR under many companies' cost of capital, and made buying the switch a bad deal – per the supplier's own business case.

Having survived two bruising recessions in the last decade, purchasing managers will not go to bat for a vendor that cannot show the financial depth that the finance department needs, or operational understanding that puts credibility behind any financial projections. With so many cost-of-ownership and payback models ending up as a big waste of time and effort, smart hardware suppliers need to reconsider how they present the financial justification for buying their equipment.

Labels:

TCO Models

Monday, July 12, 2010

Luxtera’s Contribution to All-Optical Networks

by Lisa Huff

Last week I wrote about Avago’s new miniaturized transmitters and receivers so today I’d like to introduce you to a similar product from privately-held Luxtera. Well known for its CMOS photonics technology, Luxtera actually introduced its OptoPHY transceivers first – in late 2009.

Luxtera took a different approach to its new high-density, optical interconnect solution. It is a transceiver module and is based on LW (1490nm) optics. Just like Avago’s devices, the transceivers use 12-fiber ribbon cables provided by Luxtera, but that’s really were the similarities end. The entire 10G–per-lane module only uses about 800mW compared to Avago's 3W, and they are true transceivers as opposed to separate transmitters and receivers. Luxtera is shipping its device to customers, but have not announced which ones yet.

In addition to the projected low cost for these devices, what should also be noted is that all of the solutions mentioned in the last three entries – Intel’s Light Peak; Avago’s MicroPOD and Luxtera’s OptoPHY – have moved away from the pluggable module product theme to board-mounted devices. This in and of itself may not seem significant until you think about why there were pluggable products to begin with. The original intent was to give OEMs and end users flexibility in design so they could use an electrical, SW optical or LW optical device in a port depending on what length of cable needed to be supported. You could also grow as you needed to – so only populate those ports required at the time of installation and add others when necessary. The need for this flexibility has seemed to have waned in recent years in favor of density, lower cost and lower power consumption. The majority of pluggable ports are now optical ones, so why not just move back to board-mounted products that can achieve the miniaturization, price points and lower power consumption?

Last week I wrote about Avago’s new miniaturized transmitters and receivers so today I’d like to introduce you to a similar product from privately-held Luxtera. Well known for its CMOS photonics technology, Luxtera actually introduced its OptoPHY transceivers first – in late 2009.

Luxtera took a different approach to its new high-density, optical interconnect solution. It is a transceiver module and is based on LW (1490nm) optics. Just like Avago’s devices, the transceivers use 12-fiber ribbon cables provided by Luxtera, but that’s really were the similarities end. The entire 10G–per-lane module only uses about 800mW compared to Avago's 3W, and they are true transceivers as opposed to separate transmitters and receivers. Luxtera is shipping its device to customers, but have not announced which ones yet.